I want to share some stuff about Equifax with data from my credit score.

I started taking financial stuff a bit more seriously earlier this year, and part of that was subscribing to Equifax’s $15 a month thing. You get some insurance (against like identify fraud; which is probs as good as the paper it’s written on), and regular updates WRT your credit score.

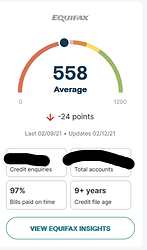

I’d noticed that my credit score had dropped without reason a few months ago, but it’s not rly something that’s easy to look in to (you get logs of credit inquiries and things but if nothing in the logs changes, there’s no way to verify the calculation AFAIK).

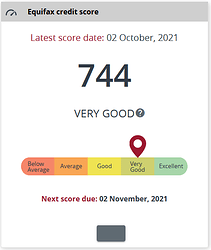

Here’s my credit score through a 3rd party that check and cache the score regularly:

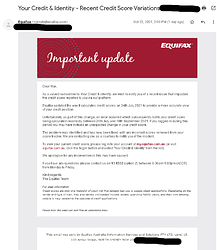

I received this email yesterday:

So basically, for at least 2 months I looked like the shittiest person to give a lone to, rather than someone reliable. I didn’t apply for any loans in that period, but say I was trying to buy a house or something – if I hadn’t already been paying equifax (for their subscription product) I would not have known that my credit was entirely misreported. How many ppl get fucked by this sort of thing? It’s a major component of modern-day consumer-level finance and literally months can go by without the responsible party taking corrective action.

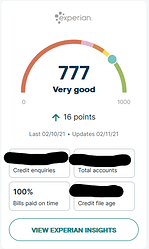

What’s it like now that it’s fixed?